When a foreigner stays in Korea for an extended period, there often arises a need to send money back home to support family or transfer funds from an overseas account to Korea. In such cases, questions often come up, like: “Are the fees too high?”, “What exchange rate do I get?”, “Are there services other than banks that offer overseas remittance?”

Fortunately, Korea offers a variety of methods for international remittance Korea and currency exchange. From traditional bank transfers to fintech solutions and crypto-based exchange, innovative options continue to emerge. This article compiles essential information and helpful tips to ensure secure and cost-effective international transfers and currency conversions.

Traditional Bank Transfers: Reliability vs. Fees

The most familiar method is using a bank account to transfer funds overseas. By accurately inputting the recipient’s name, account number, SWIFT code (or IBAN), bank name, and branch name, you can send money either at a local bank branch or via a mobile banking app. The primary advantage is reliability. Since the transaction uses secure interbank international payment networks, the risk of funds getting lost is extremely low.

The downside is that fees can be considerable. You may end up paying a combination of domestic bank fees, intermediary bank fees, and recipient bank fees abroad. You can usually choose whether the sender or receiver covers the fees, and any exchange rate discounts can also significantly impact the total cost. In summary, traditional bank transfers are a safe and prompt option, but it may be wise to explore alternatives if minimizing fees is your priority.

Fintech Remittance Services: Hanpass, Wise, Remitalk & More

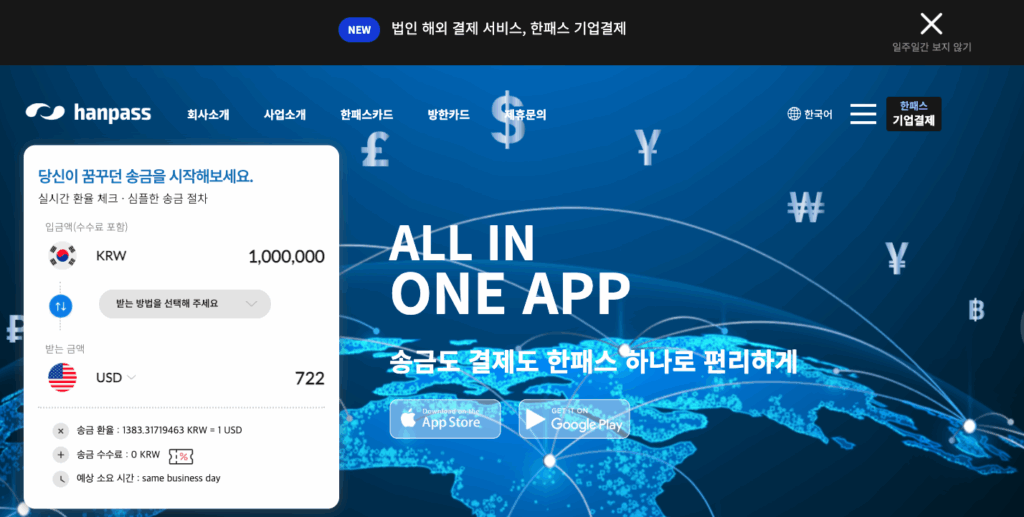

Recently, Hanpass has been gaining attention. As an innovative fintech company leading Korea’s foreign exchange market, Hanpass meets the needs of individual and corporate clients by offering various mobile-based services including international remittance, mobile payments, and PG (payment gateway) services. A key feature of Hanpass is its ability to send money to more than 200 countries, the most among domestic services. Hanpass is emerging as the standard for fast and affordable international transfers in Korea.

Launched in 2021, Hanpass’s international remittance reception service allows users to safely receive money sent from abroad. With its advanced technology, the sender only needs to know the recipient’s phone number and name, making the process much more convenient. Starting with a service launch in Australia, Hanpass plans to expand into North America, Southeast Asia, and Europe.

Additionally, fintech providers like Wise (formerly TransferWise) are transforming the paradigm of global money transfers. Rather than actually moving money internationally, these services exchange local currencies between regions, reducing fee layers and speeding up transactions. For instance, when sending money from Korea to the U.S., the sender’s KRW is matched domestically with a USD reserve Wise already holds in the U.S., and it’s paid directly from that source.

This method offers clear benefits: transparent fees and fast processing. Wise’s app and website display upfront fees, exchange rates, and estimated delivery time—sometimes even enabling same-day transfers. However, there may be limitations on the amount you can send at one time, or the account setup may be a bit tedious. Not every currency or country is supported, so it’s essential to confirm if your destination is eligible before initiating a transfer.

Using Cryptocurrency for Currency Exchange: High Risk, High Reward?

Some individuals attempt to use cryptocurrencies like Bitcoin or Ethereum to move money across borders. A typical method would involve buying crypto in Korea with KRW, transferring it to a foreign exchange, and selling it for the local currency. In theory, this approach touts reduced transaction fees, speedy delivery, and immunity to traditional exchange rate fluctuations.

In reality, however, the high volatility of cryptocurrencies can lead to significant gains or losses during the transfer process. Additionally, differing government regulations can result in legal or tax issues. In Korea, signing up for a crypto exchange requires rigorous identity verification, and anti-money laundering (AML) rules are becoming stricter. Thus, unless you are well-informed and willing to bear the risks, it’s generally not recommended to use crypto as your remittance method.

Exchange Timing and Preferential Rates: Small Tips, Big Savings

When sending money abroad, exchange is often an unavoidable step, so the exchange rate and any discounts can significantly affect your costs. Korean banks frequently offer promotional events that provide preferential exchange rates. For example, a limited-time offer could grant up to an 80% fee discount when exchanging for USD, or a 50% discount if done through internet banking. Utilizing these can cut down your fees substantially.

Because exchange rates fluctuate constantly, timing your conversion carefully may help you get a better deal. While short-term exchange rate predictions are difficult, keeping an eye on monthly trends or reacting to global events can help. While the difference may not be huge for small transfers, frequent transactions can lead to considerable cumulative savings.

Linking with Mobile Payment & Remittance Apps

Apps like Toss, Kakao Pay, and Naver Pay now offer international remittance features. After linking your Korean bank account to recharge KRW or entering overseas account information, you can easily check exchange rates and fees within the app and initiate the transfer. The main advantages are user-friendly interfaces and less cumbersome identity verification processes.

However, each app may have restrictions on transfer limits and the supported countries or currencies. It’s important to compare their fees carefully with traditional banks. Some apps also provide promotional events or reward points, which can be beneficial if used wisely.

Legal Limits and Tax Reporting

Under Korea’s Foreign Exchange Transactions Act, individuals are required to report to the National Tax Service if they send or receive more than a certain amount overseas annually. Generally, if the total exceeds USD 50,000 in a year, the bank or financial institution becomes obligated to notify authorities. You should also check tax laws in your home country and any applicable double taxation agreements.

This is particularly important when remitting living expenses to family members, as it could potentially be considered a gift, raising concerns about gift taxes. Under typical circumstances, remitting modest amounts for education or living expenses is not problematic, but repeated large transfers could attract scrutiny. If you plan on sending significant funds regularly, it’s best to consult a tax expert or banking professional to ensure compliance with legal procedures.

Case Study: Mr. M’s Urgent Remittance to the U.S.

Mr. M, an American working in Korea, needed to urgently send USD 3,000 to the U.S. for a family medical emergency. While he initially considered using a traditional bank transfer, he was concerned about the high fees and processing time. After hearing recommendations about the fintech service Wise, he checked the exchange rate and fees using the app and found it significantly cheaper than bank rates—with same-day delivery as a bonus.

He transferred KRW equivalent to USD 3,000 from his Korean bank account into the app, entered the U.S. account details and recipient information, and the funds were successfully received within two days—at about half the cost compared to bank transfers. Although larger transfers might have required additional documentation, this amount went through smoothly. “It was comforting to know there’s a solid alternative in emergencies,” Mr. M said.

Conclusion: International Remittance Korea, Choose the Method That Best Suits You

For foreigners living long-term in Korea, international remittance and currency exchange are essential. With multiple options—from traditional banks, fintech apps, and cryptocurrencies to mobile payment services—it’s important to assess the pros and cons of each and pick the one that fits your needs. Your ideal choice depends on what you value most—security, low fees, speed, or convenience.

Also, don’t overlook legal limits and tax issues. Large annual sums may require bank reporting, and you could be liable for taxes either in your home country or Korea. Familiarize yourself with relevant regulations in advance and consult professionals when necessary to avoid any complications.

Ultimately, international remittance isn’t just about moving money—it’s a vital link between your life in Korea and your home country. Whether it’s sending living expenses to parents or family, or bringing overseas assets into Korea for business or property investments, having transparent and cost-effective methods helps you protect your assets and minimize currency loss or fees.

K-Name Studio: Create your perfect Korean name based on your personality and style.

What’s My K-Beauty Personal Color?

WeBring Service : Provides personalized services to foreigners living in Korea

Exclusive offer: Introducing foreign car rental in Korea, WeBring-SoCar