In this post, “visa extension” generally refers—using standard Korea Immigration terminology—to Permission to Extend Period of Stay. It doesn’t mean changing your status of stay (visa type) itself; it means keeping your current status (D-2 or E series) and extending the duration. Let’s take a calm, step-by-step look at Korea visa extension documents.

1) When can you apply? (Timing is where rejections start)

Extending your period of stay is 안내되어 as available from 4 months before your period of stay expires, and you must apply by the expiration date (for e-application, by the day before the expiration date).

👉 Conclusion: Once you can see your expiry date coming, the safest approach is not “do it all at the last minute,” but to start preparing the moment the 4-month window opens.

2) Where/how do you apply? (Online vs. in-person)

- E-Application (HiKorea): For statuses eligible for e-application, it is 안내되어 that you can apply online.

- In-person application (competent Immigration Office/Branch Office): For in-person applications, many resources 안내되어 making a visit reservation through HiKorea. (Easy Law)

The Ministry of Justice also 안내되어 that you can handle permissions such as extension of period of stay without a visit through HiKorea and that there is also a 20% fee reduction (the applicable scope may vary depending on which services/eligibilities are available for e-application). (Ministry of Justice)

Hours for using e-application are also 안내되어 separately (weekday operation). (HiKorea)

3) One-page checklist of “common required” items for D-2 / E series

The core common documents specifically listed in immigration 안내자료 are just four items.

A. Documents (minimum required 4 items)

- Integrated Application Form (Appendix No. 34) – check “Permission to Extend Period of Stay” + signature/contact info required

- Passport

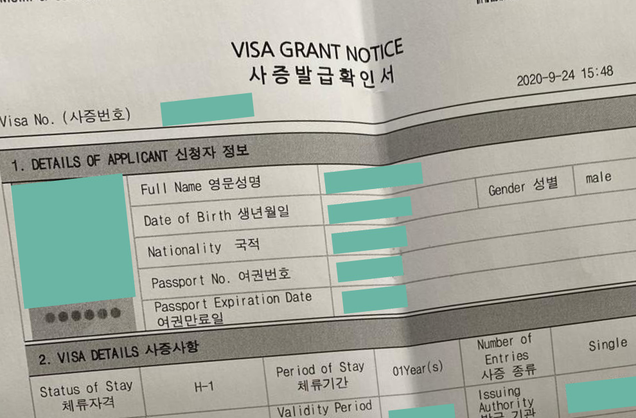

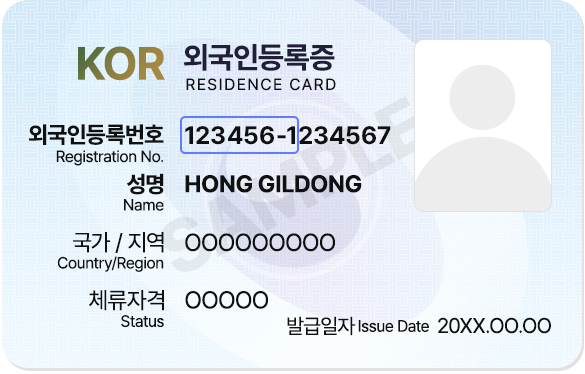

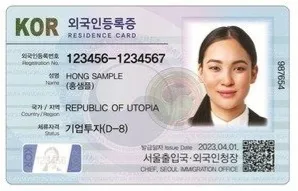

- Alien Registration Card (ARC)

- Proof of residence (address verification) (lease contract, dorm confirmation, accommodation provision confirmation, etc.)

B. Cost (the point almost everyone gets confused about)

- Fee: KRW 60,000 (Permission to Extend Period of Stay) (Law.go.kr)

Note: “Issuance/reissuance of an Alien Registration Card (card) KRW 35,000” and visa extension (extension of period of stay) KRW 60,000 are different fees. (Law.go.kr)

C. What you additionally need when applying online (e-application)

- Prepare scanned/photographed files (PDF/JPG, etc.) (passport, contract, etc.)

- An identity verification method (joint certificate, etc., depending on system requirements)

4) For D-2 (study abroad) extensions, additional documents (official 기준)

According to the Enforcement Rule of the Immigration Control Act (table of attached documents), the key additional documents for a D-2 extension of period of stay can be summarized as follows.

D-2 additional documents (official)

- Certificate of Enrollment

- If you are preparing a master’s/PhD thesis, it is 안내되어 that you may substitute a recommendation letter from your academic advisor or a confirmation of government-invited scholarship recipient.

- Financial proof documents (tuition/living expenses)

- (If conducting certain research) Documents proving research activities

For D-2, online extension is also frequently 안내되어

There are cases where university notices 안내되어 extending the D-2 period of stay via HiKorea e-application (operating methods may vary by school/jurisdiction). (grad.aks.ac.kr)

5) For E series (employment) extensions, additional documents (official 기준)

There are many E-series categories, so it’s not that “all E are identical,” but if you look at the official table of attached documents, the backbone of an extension is ‘employment relationship + business entity proof + (if applicable) additional requirements’.

Below, focusing mainly on E-2 / E-3 / E-4 / E-5 / E-7 which especially come up often in practice, I’ve extracted only the items that correspond to extension (permission to extend period of stay).

E-2 (Conversation Instructor) extension

- Employment contract

- Business Registration Certificate (for corporations, a Certificate of All Registered Matters)

E-3 (Research) extension

- Employment contract

- Business Registration Certificate (for corporations, a Certificate of All Registered Matters)

E-4 (Technological Guidance) extension

- Dispatch order or certificate of employment

- Related documents such as proof of technology introduction contract/reporting (within the applicable scope)

- Business Registration Certificate (for corporations, a Certificate of All Registered Matters)

E-5 (Professional Employment) extension

- Employment contract

- Business Registration Certificate (for corporations, a Certificate of All Registered Matters)

E-7 (Specially Designated Activities) extension

- Employment contract

- (For applicable occupations) Letter of Guarantee (Personal Guarantee)

- Certificate of Payment Details

One-line summary: For the E series, it doesn’t 끝 with “your documents” alone—company documents (business registration/corporate registry/payment details, etc.) also move together.

6) The 8 most common mistakes that trigger “supplement requests” (D-2/E common)

- Wrong application timing

- You prepare too early (before the 4-month window) and end up having to redo it, or you rush right before expiration and miss items. (Possible from 4 months before / e-application by the day before)

- Missing checkmark/signature/contact info on the Integrated Application Form (Appendix No. 34)

- If you forget to check “Permission to Extend Period of Stay” or there’s no signature, it becomes “fill it out again on the spot.” (Law.go.kr)

- Weak proof of residence (unclear address)

- If the contract address is ambiguous, your name doesn’t appear at all, or the accommodation-provision confirmation is flimsy, requests for supplement happen a lot.

- Not bringing original passport/ARC (bringing only copies)

- The common documents include the passport and ARC themselves.

- D-2: Certificate of Enrollment/financial proof not being the latest version

- For a D-2 extension, proof of enrollment and finances are 핵심.

- E series: Employment contract period/terms mismatch

- If it’s an extension but the contract has already ended, or if the company information doesn’t match the latest business registration, you can end up having to prepare everything again.

- E-7: Missing Certificate of Payment Details/Letter of Guarantee (if applicable)

- For E-7, attached documents for extension explicitly list items such as a Certificate of Payment Details.

- Online application but files are blurry/missing/pages cut off

- For e-application, “upload quality” is document quality. In particular, it’s common to cut off parts of the contract (address/signature page).

7) (Practical tip) This is the easiest way to bundle your documents

Common to both D-2 / E: If you organize your submitted files/paper documents in the order below, it’s easier for the officer to review and your chance of a supplement request goes down.

- Integrated Application Form (Appendix No. 34)

- Passport (bio page)

- ARC front/back

- Proof of residence (contract/confirmation)

- If D-2: Certificate of Enrollment → financial proof → (if applicable) advisor recommendation letter/research proof

- If E series: employment contract → business registration/corporate registry → (if applicable) payment details/letter of guarantee

- Prepare fee payment (KRW 60,000) (Law.go.kr)

Korea visa extension documents FAQ

Q1. When can I apply for a D-2/E visa extension?

Extending your period of stay is 안내되어 as available from 4 months before expiration, and you must apply by the expiration date (for e-application, by the day before).

Q2. What are the “common documents” for a D-2/E visa extension?

The common documents are the Integrated Application Form (Appendix No. 34), passport, Alien Registration Card, and proof of residence.

Q3. How much is the visa extension fee?

The fee for permission to extend period of stay is 안내되어 as KRW 60,000. (Law.go.kr)

Q4. What do I need additionally for a D-2 (study) extension?

Based on the official attached-document standards, the 핵심 is a Certificate of Enrollment + financial proof documents (tuition/living expenses), and there is guidance that cases like thesis preparation can be replaced with an advisor recommendation letter (if applicable).

Q5. For an E-series (work) extension, what company documents are usually needed?

It varies by category, but if you look at the extension attached-document table, the combination of employment contract + business registration (corporate registry) appears frequently. Example: E-2, E-3, etc.

Q6. Can I extend online (HiKorea e-application)?

It is 안내되어 that for statuses eligible for e-application, online application is available. However, eligibility may vary by status.

If you want, I can compress this further into a one-page sheet showing, by case type for “proof of residence documents (home contract/dorm/company housing/friend’s place)”, the document combinations that most often result in the fewest supplements for D-2 and for the E series respectively.

K-Name Studio: Create your perfect Korean name based on your personality and style.

What’s My K-Beauty Personal Color?

WeBring Service : Provides personalized services to foreigners living in Korea

Exclusive offer: Introducing foreign car rental in Korea, WeBring-SoCar